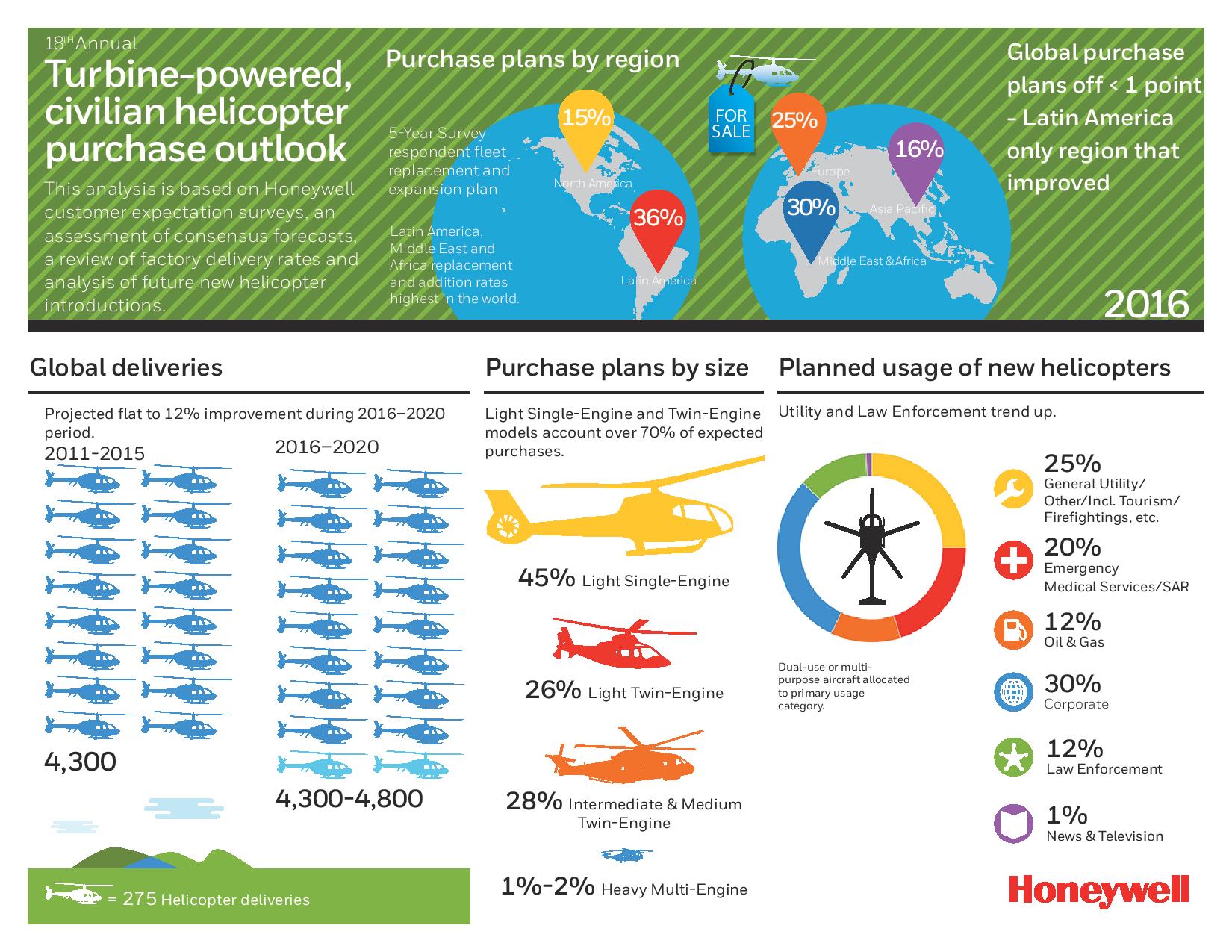

In its 18th annual Turbine-Powered Civil Helicopter Purchase Outlook, Honeywell forecasts 4,300 to 4,800 civilian-use helicopters will be delivered from 2016 to 2020, roughly 400 helicopters lower than the 2015 five-year forecast.

“The current global economic situation is causing fleet managers to evaluate new helicopter purchases closely, and that’s why we’re seeing a more cautious five-year demand projection compared with previous years,” said Carey Smith, President, Defense and Space at Honeywell Aerospace. “Even in a slower growth environment, Honeywell is well-positioned to help operators keep current fleets lasting longer with aftermarket upgrades and repairs.”

Key global findings in the outlook include:

• The survey showed new purchase-plan rates were stable, but operators cited fewer total new model purchases over the five-year period, leading to a more cautious near-term outlook.

• When considering a new purchase, operators’ results mirrored those from last year, with make and model choices for their new aircraft most strongly influenced by range, cabin size, performance, technology upgrades and brand experience.

• Helicopter fleet utilisation generally declined compared with last year. Over the next 12 months, usage rates are expected to improve but at a reduced rate.

Helicopter Use Expected to Increase

• Helicopter fleet utilisation reported in the survey generally declined compared with last year. Over the next 12 months, usage rates are expected to increase but at a reduced rate, as the gap between operators planning increases and those planning decreases has narrowed in every region.

Regional Overview

Latin America The 2016 results show strong fleet replacement and growth expectations, well above the world average, rising 8 percentage points over the prior year.

• Latin America led all global regions in the rate of new aircraft purchase plans despite an economic slowdown in Brazil.

• In terms of projected regional demand for new helicopters, Latin America is now contributing the second highest demand among the regions tracked, trailing only North America.

• Latin American respondents currently favor light single-engine models for just under half their planned acquisitions, followed by light twin-engine models at about 35 per cent and a balance of intermediate and medium twin-engine platforms for the remaining purchases.

Middle East and Africa This region has the second-highest new purchase rate among the regions, with up to 30 per cent of respondent fleets slated for turnover with a new helicopter replacement or addition.

• More than 60 per cent of planned new helicopter purchases are intermediate and medium twin-engine models.

• Heavy multi-engine models are underrepresented due to the absence of input from the large oil and gas operators in the region.

North America Purchase expectations fell 2 percentage points in this year’s survey but still provide a strong base of demand for light single-engine and intermediate or medium twin-engine platforms.

• More than 60 per cent of planned North America purchases were identified as light single-engine models, while just under a quarter of new purchases were slated as intermediate or medium twin-engine models.

• North American purchase plans are a significant component of the overall 2016 survey demand and help support global industry demand projections by virtue of the large fleet active in the region.

Europe Purchase plans decreased slightly with continued weakness in reported Russian buying plans.

• The sample of Russian operators responding in 2016 remains small, which continues to add some uncertainty to the overall European results.

• European purchase intentions currently tend to favor light twin-engine and light single-engine models in nearly equal shares this year.

BRIC countries (Brazil, Russia, India and China) Demand continues to ebb and flow with stronger results recorded for India and Brazil in the 2016 survey.

• In India and Brazil, new helicopter purchase-plan rates exceed the world average by a wide margin. Planned Chinese purchase rates slipped, reflecting near-term slower economic growth prospects.

• Notably, no Chinese-built models received specific purchase interest mentions in the survey; however, civil deliveries are occurring and are reflected in the Honeywell outlook.

|