| Dinesh Keskar, Senior Vice President of Asia Pacific and

India Sales, Boeing Commercial Airplanes flew to the Indian capital to reveal the company’s annual forecast — India “Current Market Outlook”

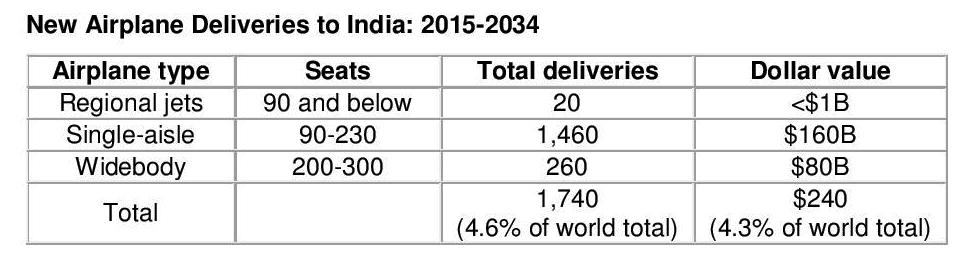

(CMO). In his estimates, in the next 20 years, India will require 1,460 single-aisle, 260 widebody and 20 regional jets, which will constitute

more than 4.5 per cent of the total global demand during the forecast period. About 170 of the 1,740 new aircraft would be replacements for existing ones.

Boeing, he stressed, has an aircraft for all the requirements of Indian commercial aviation arena, which is growing by leaps and bound, and that

the company will continue to have comfortable share in the market. Boeing will make efforts to ensure a larger share in the market in the coming years,

and thanks to the new technologies that it is developing with substantial investments, he is sure of being successful.

Globally, Boeing expects airlines will need 38,050 airplanes over the next 20 years valued at more than $5.6 trillion.

According to the Boeing Outlook, the domestic air traffic jumped almost 20 per cent in the first six months of 2015 and India

will jump six places to become the third-largest market in the world after the United States and China to around 2031, bigger than Japan, Germany and Brazil.

“The Indian market is highly competitive and airlines are adapting with added capacity, moderate pricing discipline and new business models, such as the

growing number of low cost carriers. There were 66 million passengers on domestic routes in India in 2014; in the first half of 2015 there has been a 21 per

cent climb in domestic air travel. While the number of available seat kilometers is up, revenues for airlines is up at a higher rate due to higher load factors,

the domestic market is all set to touch 75 million passengers this year.”

Dr Keskar reiterated that the operating environment has improved for airlines in the country but there is a need to get the airfare metrics right to make profits.

Of the three factors that affect the aviation market - fuel prices, exchange rate and the basic supply-demand ratio, fuel prices are very much under control,

the exchange rate is still high but it has broadly remained within a range which is positive and the demand-supply ratio isthe only area where there has been some

concern, but that is also now improving. As far as the Low-cost Carriers (LCCs) are concerned, they are seeing 90 per cent load factor and therefore there is no

concern about them. “The number of low cost carriers is projected to grow to more than 30 per cent of the total Indian market.”

He also disclosed that he had met the top leadership of SpiceJet, which is under new management, about more Boeings for the company. The outcome should be positive.

About the choice of aircraft, Dr Keskar said that the largest demand from airlines in India will be for single-aisle airplanes such as the Next-Generation 737

and new 737 MAX, while twin-aisle airplane demand, such as the 777 and 787 Dreamliner families will also continue. The number of low cost carriers is projected to

grow to more than 30 per cent of the total Indian market.

"The Indian market is highly competitive and airlines are adapting with added capacity, moderate pricing discipline and new business models, such as the

growing number of low cost carriers,” said Dr Keskar. “We continue to believe Boeing’s comprehensive airplane family meets our customers’ needs with superior

economics and fuel efficiency, improved environmental performance and a great passenger experience.”

The Next-Generation 737's market success has been confirmed by investors who consistently rank it as the most preferred single-aisle airplane due to its wide

market base, superior performance efficiency and lowest operating costs in its class. The 737 MAX will build on the strengths of today's Next-Generation 737 by

incorporating the latest-technology to deliver the highest efficiency, reliability and passenger comfort in the single-aisle market.

The 777 family provides the most payload and range capability and growth potential in the medium-sized airplane category — all with low operating costs.

Building on the passenger-preferred and market-leading 777 family of airplanes, the 777X family includes the 777-8X and the 777-9X, both designed to respond

to market needs and customer preferences.

The 787 Dreamliner is an all-new, super-efficient family of commercial airplanes that brings big-jet ranges and speed to the middle of the market. Boeing

designed the 787 family with superior fuel efficiency, which allows airlines to profitably open new routes to fly people directly where they’d like to go in

exceptional comfort. Since entering service in 2011, the 787 family has opened more than 50 new non-stop routes around the world.

Another positive information was that the Maintenance and Repair (MRO) base that the company set up for Air India as part of the offset deal on the

purchase of Boeing aircraft a decade ago, is finally operational.

“This is one of the finest MRO bases in the world and will be able to undertake the most complex aircraft checks. It has the capacity to accommodate

two 777 size widebodyaircraft in one hangar and six 737 size narrowbody aircraft in the second hangar. The trial run of a newly constructed 3.4 km long

taxiway was conducted after Air India’s Boeing 777-300 landed at the Dr Babasaheb Ambedkar International Airport, Nagpur from where it was towed by a special

tractor to MRO using the newly constructed taxiway. The $100 million MRO is constructed by Boeing and was handed over to Air India. Though Boeing completed its

work more than a year ago, taxiway construction was held up due to land litigation. Boeing used this extra time to calibrate equipment.”

|