| "Despite the current volatility in China's financial market, we see strong growth in the country's aviation sector over the long term," said Randy Tinseth, Vice President of Marketing, Boeing Commercial Airplanes. "Over the next 20 years, China's commercial airplane fleet will nearly triple: from 2,570 airplanes in 2014 to 7,210 airplanes in 2034, with more than 70 per cent of these deliveries accommodating growth."

"China's aviation market is incredibly dynamic, from its leading airlines to its startups and low-cost carriers," said Ihssane Mounir, Vice President of Sales and Marketing for Northeast Asia, Boeing Commercial Airplanes. "Boeing is committed to serve customers in the world's largest airplane market by providing the most fuel-efficient airplanes and services to support their growth and profitability."

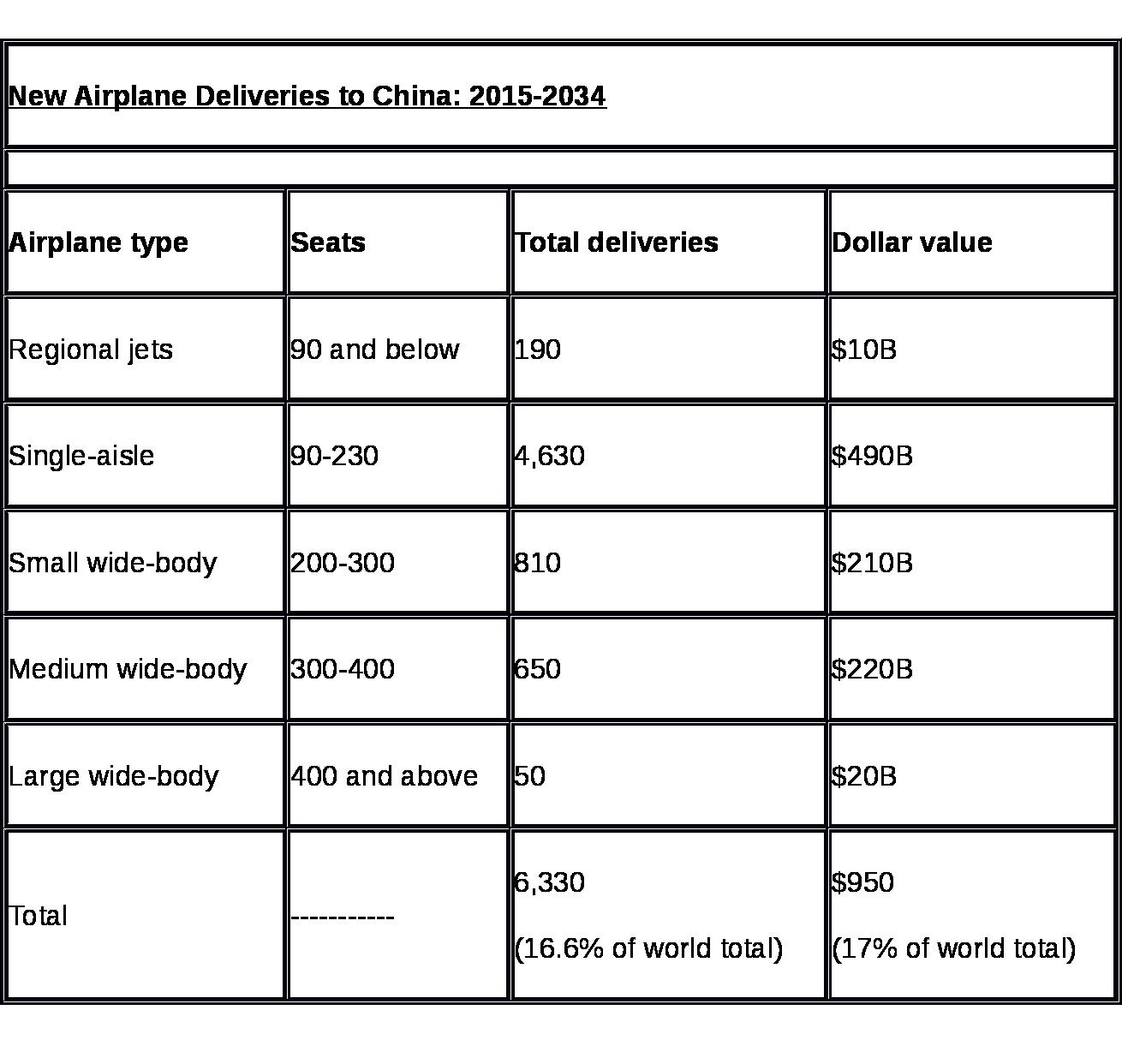

As China becomes the world's largest domestic air travel market, Boeing is forecasting demand for 4,630 single-aisle airplanes through 2034. This sector is driven by growth in new carriers and low-cost airlines in developing and emerging markets, as well as continuous expansion in established airlines. In fact, the efficiency and flexibility of single-aisle aircraft like the 737 helps Chinese carriers connect and stimulate growth along the Economic Belt as part of the One Belt, One Road Strategy. Tinseth said the Next-Generation 737-800 and new 737 MAX 8 – Boeing products at the heart of the single-aisle market - offer airlines the best fuel efficiency, reliability and capability.

China's low-cost carriers are currently responsible for about eight per cent of single-aisle market demand, rising to 25-30 per cent of demand by 2034, Tinseth noted. "The 737 MAX 200 will have the lowest fuel costs – 20 per cent per seat – versus today's most efficient single-aisle airplanes," Tinseth said. "737 MAX fuel efficiency and the 737's position as the industry's most reliable airplane offer Chinese low-cost carriers competitive advantages as they grow new business."

Boeing forecasts that the widebody segment will require 1,510 new airplanes, led by small and medium widebody airplanes such as the 777-300ER (Extended Range), 777X and the 787 Dreamliner. Tinseth stressed that Chinese airlines have more than doubled their long-haul international capacity over the past three years, in large part following the delivery of 747-8 Intercontinental airplanes to Air China and 777-300ERs and 787s to several leading Chinese carriers.

"Enabled by China's growing middle-class population, new visa policies and the underlying strength of its economic growth, this expansion is expected to continue, and in fact accelerate," Tinseth said. "The 777, 787 and 747-8 are perfectly positioned to support Chinese airlines' continued globalisation."

Worldwide, Boeing projects investments of $5.6 trillion for 38,050 new commercial airplanes to be delivered during the next 20 years. The complete global forecast is available at www.boeing.com/cmo.

Today, Boeing jets are the mainstay of China's air travel and cargo system. More than 50 per cent of all the commercial jetliners operating in China are Boeing airplanes. Over 8,000 Boeing airplanes fly throughout the world with integrated China-built parts and assemblies. China has a component role on every current Boeing commercial airplane model – the Next-Generation 737, 747, 767, 777, as well as the world's newest and most innovative airplane, the 787 Dreamliner.

|